Reimbursement Policies and Procedures

Before submitting the paperwork for reimbursement please read the following guidelines very carefully.

Please submit the receipts for conference registration fee, transportation, visa fees, and lodging to macmillan.fellowships@yale.edu within ten days after completing your travel. The MacMillan Business Office will not be able to accept reimbursement requests after forty-five days from the last day of your conference.

1. Receipts. Please submit the receipts within 10 days after the conference. Please attach your receipts in legible form and in one pdf.

- All reservations have to be in your name.

- The airfare must be Economy class only.

- Yale will reimburse airfare luggage fees for one bag only.

- All expenses must be paid for with your credit card. We cannot process the reimbursement if the payment was made by anyone other than you. We will make an exception if students share a room during the conference.

- For shared rooms please submit the following: shared room request form, proof of reservation and proof of payment.

- These charges are not reimbursable:

- Flight: fees for snacks, non-alcoholic/alcoholic drinks, checked baggage, Wi-Fi, pillows and blankets, and preferred coach seating, insurance, any additional upgrades, and etc.

- Accommodations: lounge access, room service, Mini bar charges, Internet connection, in room movies, spouse/guest related charges, laundry, etc.

- Car rental: GPS, insurance on cars, etc.

- Membership fees**Unless required for registration

- Food

- Please note: If any of your expenses are older than 120 days or will reach this limit in the next 10 business days you will need to provide additional paperwork listed below. The reimbursement will be processed as a check request (which takes a little bit longer and is considered taxable income) and will be mailed to you.

a. Mailing address

b. Non US Citizens have to submit W-8BEN and request the link to FNIS web-based application.

2. MacMillan Center’s Award letter.

3. Proof of payment. A card statement with your name and date clearly visible, as well as the charge highlighted will be accepted.

4. Proof of participation. A conference brochure with your name highlighted will suffice.

Please click here to start the reimbursement request.

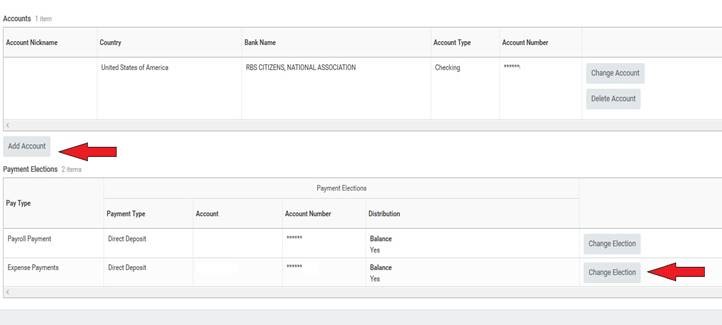

Make sure that you are set up with Direct Deposit in WorkDay.

- Go to http://your.yale.edu/

- Login with your NetID and Password

- Find My benefits/MyPay Info

- Choose Pay Icon

- Payment Elections

Make sure that your Direct Deposit is fully set up. The Payment Type for Expense Payment should be Direct Deposit.

Make sure that your Direct Deposit is fully set up. The Payment Type for Expense Payment should be Direct Deposit.

Airbnb Lodging Reservations

Yale travelers are permitted to use Airbnb for lodging. The required method for arranging Airbnb lodging is the Yale Airbnb for Business platform, using a Yale email address.

How to get started:

- Access Airbnb and then select “Get Started.” You will be prompted to login to your existing Airbnb account or set one up if you don’t have one.

- Next, you will be asked to enter your Yale email.

- Be sure to verify your work email as soon as you receive the Airbnb verification email by clicking the “Verify Business Email” link. Verifying your Yale email will give you access to Yale’s Airbnb platform and prioritized support, should you need it.

Car Rentals

The University has negotiated discounts with preferred rental car agencies. Travelers should rent the most economical (compact or midsize) vehicle consistent with business needs and travel circumstances.

Insurance for Domestic Rentals:

- Do Not Purchase insurance coverage of any kind when renting from a preferred vendor within the contiguous 48 states. Insurance is automatically included with rentals within the 48 contiguous states, including the District of Columbia.

- Travelers should decline any additional insurance coverage offered by car rental companies. It duplicates insurance already provided by Yale and will not be reimbursed.

- Policies & Insurance

Mileage Reimbursement

The use of a personal vehicle will only be reimbursed at the federal mileage allowance rate for business travel. This rate covers the cost of vehicle usage, including gasoline. The traveler will not be reimbursed separately for gas expenses. Travelers will, however, be reimbursed for tolls and reasonable parking fees.

Mileage Allowance Rate : 58.5 cents per mile (as of 1/1/22)

The attachment of Google Maps showing the mileage and starting and ending locations is accepted documentation for mileage reimbursement.

Note: There is a limit on vehicle reimbursement of no more than the economy class airfare for a similar trip.